The Stock Market Is Crashing: What Am I Doing With My Portfolio?

Is the stock market crashing? Just over a week ago, I shared a post titled ‘Preparing For A Stock Market Crash – What You Need To Know.’ In the short period between writing that post and now, the stock market has seen a bit of a tumble. I want to give an update on the impact that this has had on my investing portfolio and what I plan to do.

Why The Stock Market Is Crashing

You may have seen that over the past month, but especially the last few days, the stock market has been dropping at a notable rate. There is uncertainty and fear regarding the impact of Trump’s tariffs, and this is causing widespread panic amongst investors. But why are tariffs causing this panic?

When one country (in this case, the US) begins to impose tariffs on other countries, they are making it more expensive for their own consumers (in this case, US citizens) to buy things from the countries that have had tariffs imposed on them (if the companies affected pass on these additional costs to consumers). Think of it as an additional tax.

So, if prices begin to rise for consumers buying things from these countries, they may buy less, which could hurt the economy. Investors are seeing this as a negative thing at the moment, which has led to a stock market sell-off. And investors will have been less pleased to see Trump provide a vague answer as to whether the tariffs will lead to a recession in the US.

Remember, the stock market is a weighing machine. If more people want to sell than there are people who want to buy, prices will come down and vice versa.

So, should we be worried?

What’s most important to take away is that nobody knows what the stock market is going to do today, tomorrow, next week, next month, or even in the next five years. It is unpredictable, and trying to ‘time’ or guess what the market is going to do is a fool’s game.

My Investing Portfolio

I logged into my Trading 212 account earlier this week and was met with a nice red downward arrow, clearly showing me that I was in the red for the last month. Since I am passionate about educating anyone and everyone about financial literacy, I believe that it is important to be transparent about my portfolio. It also shows you that I do indeed have ‘skin in the game’ and I am not merely suggesting what I would do, I quite literally will be explaining how I have reacted to the recent sell off. So, here we go.

Over the past month, my personal investing portfolio has fallen by £1624! Ouch! Don’t get me wrong, it’s never easy to see my portfolio in the red by so much money, but as I mentioned in my previous post on stock market crashes, it is so important to take a step back and realise the type of investor I am. Moreover, I only invest what I can afford to!

I am investing for the long term, probably 20 years or more from now. So, to me, a short-term crash is irrelevant in the grand scheme of things. I’m not worried about what is happening now, and as a result, I am mentally prepared. I am not going to make any irrational or emotional decisions based on short-term market movements.

I am going to be doing absolutely nothing! If we look at US stock market returns over the last 30 years, you will see why I am not panicking and selling my investments.

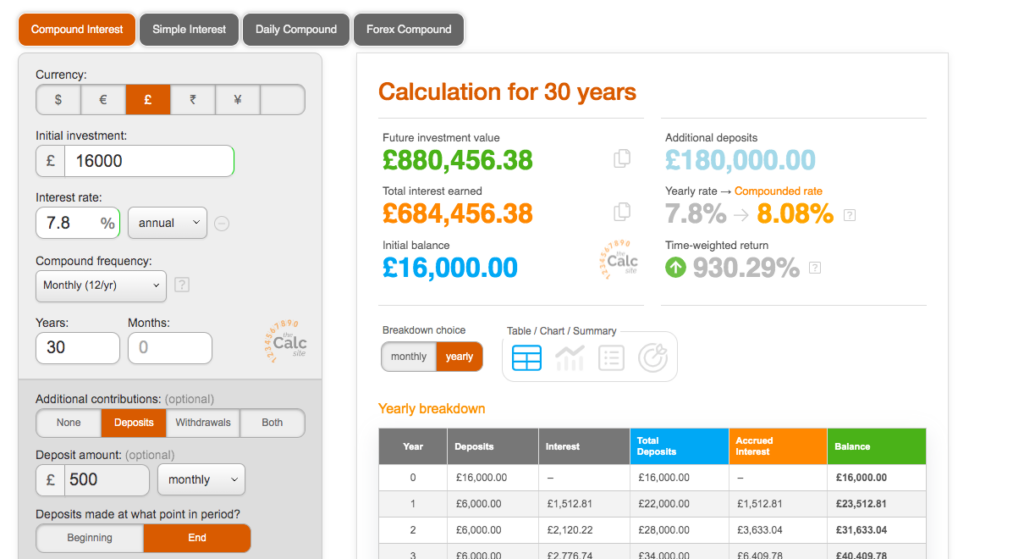

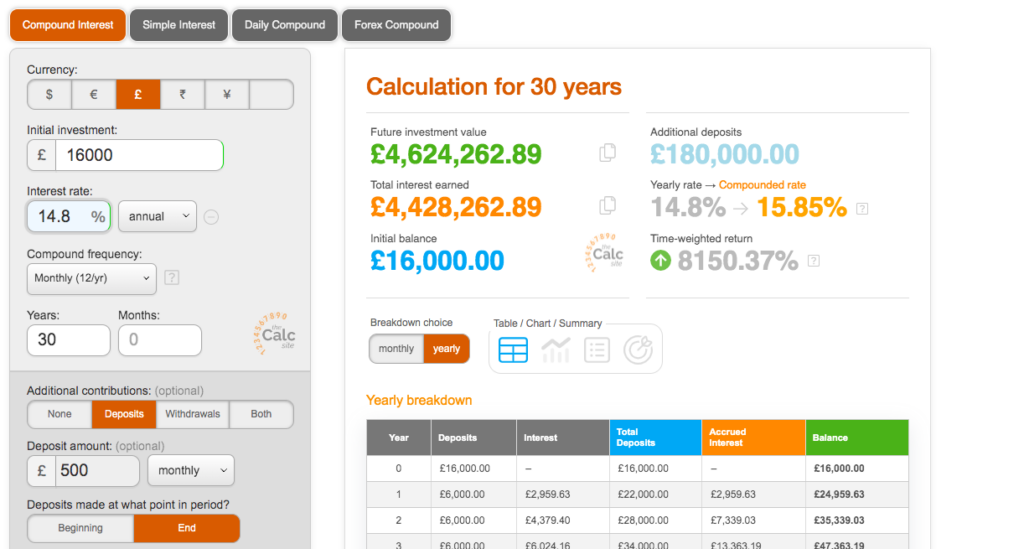

Since 1926, if we look at any 30-year period of stock market returns, the lowest annual return delivered by the S&P 500 has been 7.8%, whereas the best has been 14.8%. This is despite investing through extreme market crashes, including the great depression of 1929 (for the lower return).

Personally, I am encouraged by this, and whilst past returns are not guaranteed in the future, it helps ensure that I do not make an irrational decision in the short term.

If I carry on investing what I currently do each month, a 7.8% return would lead to a total investment portfolio of £880,000! 14.8% would lead to a total investment portfolio of £4.6 million.

As a side note, I am not just invested in the US stock market, but I have global exposure. However, since the US stock market makes up roughly 70% of the global stock market, my portfolio is skewed towards the US, hence why I have used the above examples.

For proof as to how I came to the calculations above, see the below screenshots- I used the compound interest calculator here.

The Stock Market Is Crashing- Why Am I Barely Looking At My Investment Portfolio

I cannot emphasise enough the power and strength it takes not to spend each day opening up your investment portfolio to assess whether you are up or down.

You might look on one day and your investing portfolio is up, and another day it may be down. Looking at the day it is down could lead to knee-jerk or irrational decisions that are not aligned with your long-term goals.

Personally, I aim to login once or twice a month, take a quick look at what’s going on and get out of there pretty swiftly. In an ideal world, I would only log in when I get paid, invest a portion of my salary, and leave it until the next month.

Over the last two and a bit years that I have been investing in the stock market, this has helped me to avoid irrational decisions. I am focused on my long-term goals, and I am not going to get caught up in the noise of short-term thinkers.

Final Thoughts

So yes, the stock market has taken a bit of a tumble over the past month or so, and it may continue to fall even more. Nobody knows! Remember why you are investing and consider: if you are a long-term investor, will all the noise and fear right now matter in 20 or 30 years?

Trying not to look too often at your investing portfolio will be another useful way to avoid knee-jerk reactions to short-term stock market movements. This is more of a psychological point, but it has sure helped me to avoid panicking and selling.

I’d love to hear your thoughts on what you are doing amidst the recent stock market sell-off. Feel free to leave a comment below!