The Power of Compound Interest: Use This Compound Interest Calculator & Be Amazed

What if I told you that just £100 per month could turn into £100,000? That’s the power of compound interest. There’s a reason why Albert Einstein famously labelled it as the eighth wonder of the world. In this post, I’ll break down compound interest in the simplest way possible— how it works, why it’s so powerful, and how it can help you build serious wealth. To emphasise the power of compound interest, I’ll give examples of how a small amount of money can ‘compound’ into serious sums.

Please note that this content is for informational and educational purposes only and is not financial advice.

What Is Compound Interest?

Imagine a snowball rolling down a hill; it begins to get bigger as it rolls but as it gains more momentum, the rate at which the snowball gets bigger and accumulates more snow picks up and before you know it, the tiny snowball you started with has turned into a massive snowball. That is essentially how compound interest works; it is where you earn interest on top of the original interest you have already earned. Suppose you begin with £100 and earn 5% interest annually, let’s compare the outcomes using compound interest and simple interest calculations.

With ‘simple interest’, £100 earning 5% each year would pay £5 at the end of year 1 leaving you with £105. At the end of year 2, you’d earn another £5 bringing your total to £110. By the end of year 3, you’d collect another £5, reaching £115 in total.

With compound interest, £100 earning 5% each year would pay you £5 at the end of year 1 leaving you with £105. However, in year 2, instead of being paid £5 interest, you earn 5% on the £105 giving you a total of £110.25. At the end of year 3, you earn 5% on the £110.25 giving you a total of £115.76.

Right now, you might be thinking: ‘Why does a measly 76p (£115.76 vs £115) difference even matter?’ But this is where things begin to get really exciting, if you give compound interest enough time to work its magic, it doesn’t just grow your money, it will explode it to amounts you would not believe. Keep reading, and you’ll see why Einstein called it the eighth wonder of the world.

The Power Of Compound Interest

As mentioned, compound interest is where you earn interest on top of the interest you have previously earned. I want to use some more examples to really show you the impact it can have and also make clear that like with the snowball example, you can start with a small amount. I’ll be using the compound interest calculator by the calculator site to complete the calculations.

To further illustrate the power of compound interest, I will use some basic stock market data- don’t be afraid if you don’t understand it at this point. According to Curvo, the FTSE All-World Index (essentially a fund that seeks to replicate the returns delivered by the global stock market) delivered an annual average return of 10.8% over the last 20 years. Let’s take this 10% average return and play around with a compound interest calculator. Please note that returns are not guaranteed; the 10% figure is based on past data and does not indicate future performance.

£100 invested every month for 20 years with a return of 10% will be worth £76,669.69. If this was done for 30 years, it would turn into £228,032.53. Isn’t that amazing, a reasonably small sum saved each month earning average returns can turn into such a huge sum. But what if more than £100 was saved, say £250?

£250 invested every month for 20 years with a return of 10% will be worth £191,674.23. If this was done for 30 years, it would turn into £570,081.33. What about £500?

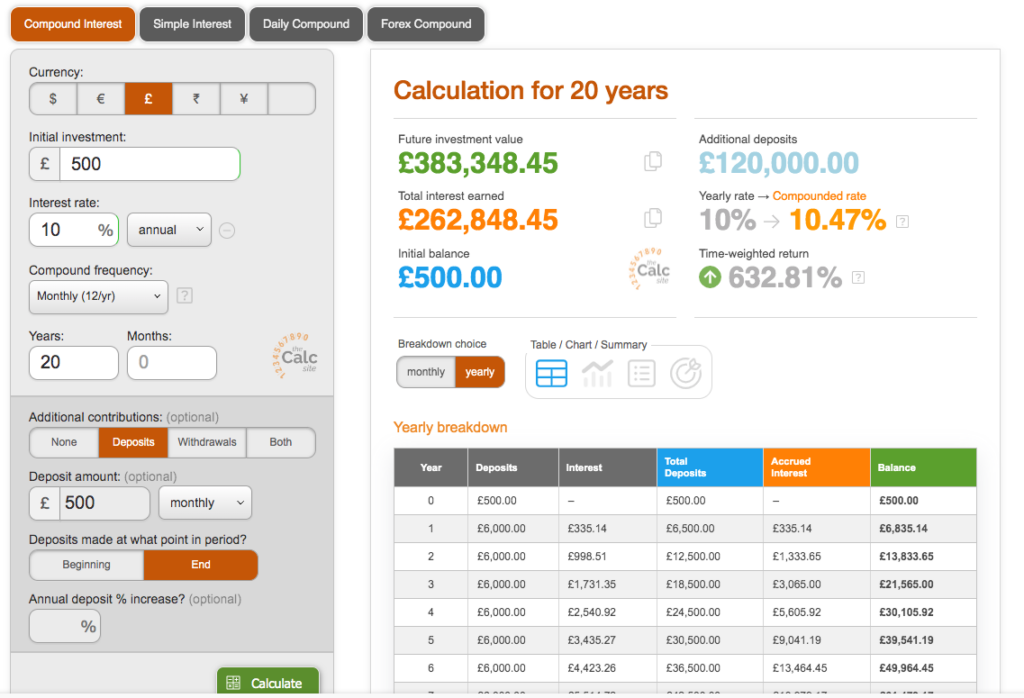

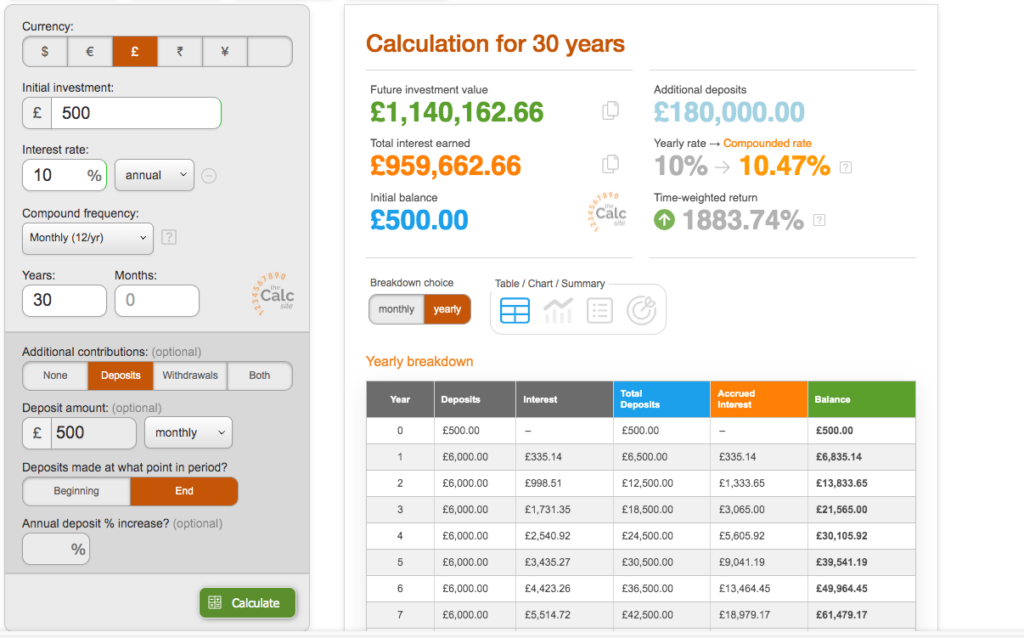

£500 invested every month for 20 years with a return of 10% will be worth £383,348.45. If this was done for 30 years, it would turn into £1,140,162.66.

This is the power of compound interest- the power of earning interest on top of your interest. As you can see (just like a snowball), as the number grows and earns interest, and then interest on top of this interest, the growth accelerates. Use the calculator to explore different scenarios, but remember that actual market returns can vary significantly. I have inserted a couple of screenshots below to illustrate the £500 calculations so you can understand how I have used the calculator.

Here is a table summarising the power of compound interest using different numbers and assuming a 10% average return.

| 10 years | 20 years | 30 years | 40 years | |

| £100 per month | £20,755.20 | £76,669.69 | £228,032.53 | £637,778.02 |

| £250 per month | £51,888.01 | £191,674.23 | £570,081.33 | £1,594,445.06 |

| £500 per month | £103,776.01 | £383,348.45 | £1,140,162.66 | £3,188,890.12 |

| £750 per month | £155,664.02 | £575,022.68 | £1,710,243.99 | £4,783,335.18 |

| £1,000 per month | £207,552.02 | £766,696.91 | £2,280,325.32 | £6,377,780.24 |

Now this is by no means financial advice, this is purely to educate you on the power of compound interest. Use the calculator here; play around with different numbers, and perhaps reduce the percentage interest rate return to see potential outcomes. What this shows is that over enough time, compound interest can have a tremendous impact. A relatively small amount can snowball (pun intended) into considerable amounts and as you can see, the more saved, the larger the potential outcomes. This does not take into account the effect of inflation, but I will cover this in a future post.

It is important to note that returns are of course not guaranteed, the 10% figure used above is based on past data and is not an indicator of the future. The stock market (which I will go into greater depth in future posts) can of course go down in some years as well as go up. Who knows what will happen in the future- I certainly don’t!

How To Make The Most Of Compound Interest

There are a few factors to consider about how to make the most of compound interest which I have listed below.

- Patience- This is probably the most important thing to understand about compound interest. Compound interest requires you to play the waiting game, it is not a get-rich-quick scheme. You need to be willing to wait for years for compound interest to do its thing. As you can see, the longer the period you leave compound interest to work, the larger the number becomes. If you use the calculator linked above and put in 1 or 2 years, the numbers are not as impressive.

- Consistency- Continuing to add money consistently is one of the key factors behind the growth you can see above. Assuming you began with £100 and did not add anything further and waited 30 years (earning 10%), you would have £1,983.74. But by consistently adding a little bit each month, you can see from the table above that £100 could turn into £228,032,53 after 30 years. This shows the power of ‘drip feeding’ or consistently adding money.

- The earlier the better- The longer you leave the money and let compound interest do its thing, the more growth you are likely to see. This is exemplified by the above where the numbers grow exponentially as you wait 30 or 40 years. This is why starting as early as possible is advantageous.

- Not taking money out- Withdrawing money will reduce the amount of money available for compound interest to work its magic. Read my post on having an emergency fund to react to all the different things that can happen in our lives. I take the view that any money I invest in the stock market is money that I can (if everything goes wrong) afford to lose. I do not plan on touching it for years to come.

Final Thoughts

Now I hope you can see the true power of compound interest! Patience, consistency, and discipline can go a long way when we consider the power of compound interest. Now you see why Einstein called compound interest the eighth wonder of the world! Understanding and taking advantage of compound interest can yield results that you probably could not imagine before reading this post- I hope you have learnt something from this.

Now that you understand the power of compound interest, take the next step! Check out my guide on Tax-Free Investments in the UK: How To Grow Your Wealth with ISAs.

As a reminder, this content is not financial advice and is for educational purposes only. Please make sure to conduct your research and consult with a qualified financial advisor should you require personalised recommendations.