Saving for a House? Here’s How to Get Up to £1,000 Of Free Government Money For Your Deposit Every Tax Year

The Challenges Of Saving For Your First Home

Saving for a deposit for your first home is extremely challenging given the rise in the cost of living and the length of time it can take. In this post, I want to share information about how the government are offering first-time buyers in the UK up to £1,000 per year in tax-free cash to help you save for your first home deposit. Expect to learn about the key product you need to understand to take advantage of this offer, eligibility criteria, opportunities to earn additional money on top of the £1,000 government offer, and all the key considerations you need to make before working out if this is the right thing for you. Like always, this is not financial advice, it is simply educational content to help improve your personal finance knowledge.

How A Lifetime ISA Can Speed Up Your Home Purchase

You may have read my previous post about tax-free investments in the UK where I gave a brief outline on the Lifetime ISA (LISA). A LISA is designed for two outcomes, either saving for a first home deposit or for retirement. For this post, I am solely going to focus on the house deposit side of things.

Saving for a deposit for your first home has never been more challenging. House prices have been rising and this is making it harder for first-time buyers to save money for a deposit which is commonly around 10% of the home value. This is making getting on the property ladder harder and harder.

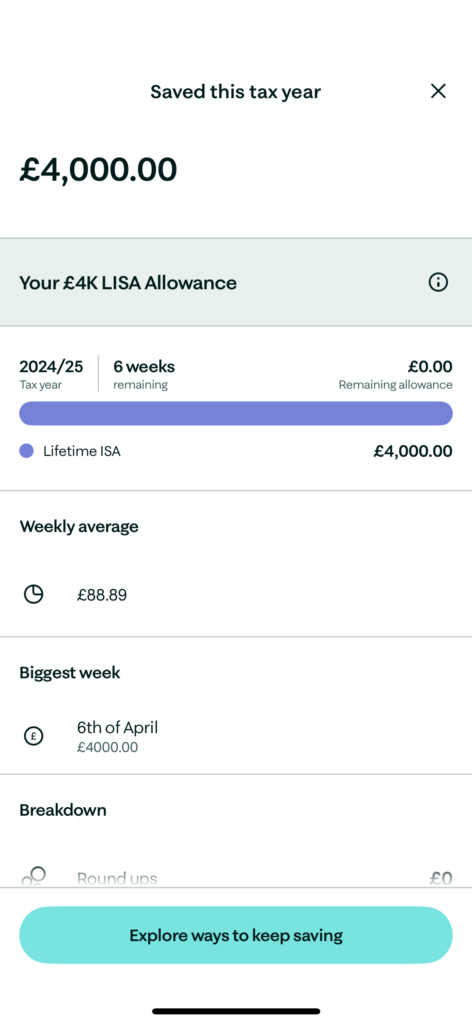

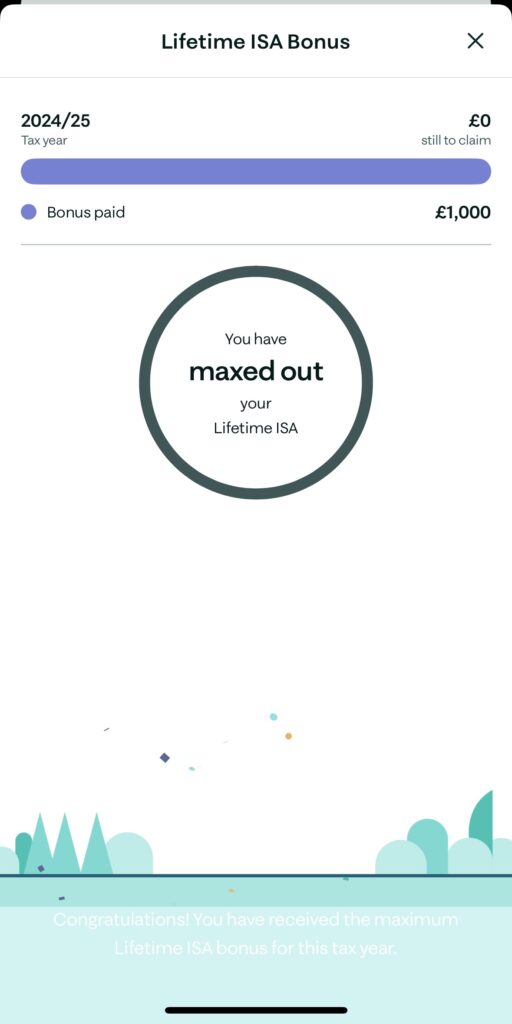

A LISA is an account where you can deposit up to £4,000 per tax year and the government will top up your deposit by an additional 25%! So if you deposited £4,000 into a LISA in the tax year, the government would top this up by £1,000 (£4,000 x 25%) giving you a total of £5,000. The £1,000 government top-up is commonly referred to as a government bonus. Additionally, the bonus provided by the government is completely tax-free.

It’s important to know that you don’t have to deposit £4,000, you can deposit anything from £1 (depending on the provider) up to £4,000 per tax year. Maxing out the LISA deposit will attract the higher government bonus but even depositing £1,000 will lead to a £250 bonus (£1,000 x 25%). It is free money; if you are only using a separate savings account that is not a LISA to save for your first home deposit, you are leaving money on the table.

Now you might wonder if you can make multiple deposits. The answer is yes- you can deposit up to £4,000 into a LISA per tax year (it doesn’t have to all be at once, it can be in multiple deposits) and receive the government bonus of £1,000 giving you £5,000 in total. And when the next tax year begins you can deposit up to £4,000 again and receive the 25% government bonus on top. So if you did this for two years and maxed out your contributions each year, you would have £10,000 (£2,000 of free money from the government). This could bring forward or reduce the time that it takes you to save for your first house deposit!

Here are two screenshots showing the £4,000 being deposited and the £1,000 government bonus being paid giving a total of £5,000 saved all within the same tax year.

Now there are some eligibility criteria which you need to be aware of.

Who Is Eligible For a LISA?

To be eligible to open a LISA and take advantage of the free money on offer from the government, you need to meet the following criteria:

- You must be a UK resident

- You must be aged between 18 and 39 (but you can contribute up to the age of 50)

- The money accumulated (including the government bonus) must be used for your first home deposit (or retirement, but for this post, we are focusing on a house deposit)

- You must be taking out a residential mortgage

- The property purchase price can be a maximum of £450,000

If you meet these criteria, you could be benefitting from up to £1,000 of free government money per tax year.

How To Get Double The Government Contribution

If you were saving for a home with your partner (and you were both first-time buyers), you can both open a LISA and contribute up to £4,000 per tax year. So if you both contributed £4,000 into your own LISA’s in one tax year, you would both get a £1,000 bonus from the government! So £8,000 of savings becomes £10,000 which further accelerates the rate at which you can build up your deposit. If you did this again in the next tax year, you would have £20,000 saved in total (£16,000 in contributions and £4,000 in government bonuses). Providing that you are both first-time buyers, this is how you can get up to £2,000 extra towards your first house deposit in each tax year.

This is how my partner and I were able to put down a larger deposit for our first home, the 25% bonus on offer from the government was far too lucrative to say no to!

Stocks & Shares LISA

Everything that I have talked about so far has been about a Cash LISA- i.e. an account where you deposit money towards your first home and the government tops this up by 25%. However, there is a stocks and shares version of the LISA. Here, the same rules as above apply but you can invest your money into the stock market.

The key thing to understand here is that it could either further boost your savings if your investments perform well or you could lose money if your investments fall in value. The key consideration here is how long you have before you want to take the money from the LISA and use it for your first home deposit. The general view of investing is that you should be willing to invest for a minimum of 5 years.

If I was saving for a house that I wanted a deposit for next year, I would be much less likely to favour a stocks and shares LISA purely because of the risk of loss from any investments made. For me, the value gained out of owning a home would outweigh any potential investment gains from using a stocks and shares LISA.

On the other hand, if you were not planning on buying a house anytime soon (perhaps in 5 years time), you could opt for a stocks and shares LISA as the impact of the government bonus and compound interest from investments. It is riskier than a standard cash LISA but if your investments grow, you could benefit from this as well as the government bonus which could really boost your deposit.

This is not any form of financial advice but just food for thought when it comes to deciding what type of LISA might be the best for you (cash or stocks and shares).

LISA Providers

In the UK, there are multiple LISA providers. When I was working out who to open a LISA with, I used the Money Facts Compare website to find the best provider for me. The reason for this is that on top of the government bonus, providers will also offer you interest for putting your money for a house deposit with them. I wanted to choose the provider that offered the best service but also a good interest rate so I could further boost my deposit.

You can see from the link that there are several providers of LISA’s in the UK; you may recognise a few such as Moneybox and Skipton Building Society. Some accounts are managed in different ways (e.g online or via an app or both) so it is always best to check which one will work best for your circumstances.

If you were to open a stocks and shares LISA, you would not be paid any interest by the LISA provider, you would be reliant on investment gains to further boost your deposit on top of any government bonus received.

Whilst saving for a house deposit, the LISA provider I used was also paying 3.80% interest. This was a major boost to our deposit on top of the government bonus we received. So we received a £1,000 bonus from the government, and interest from the LISA provider just for choosing to use them to store the money!

Always conduct your own research to work out the best provider for you.

Key Considerations Before Opening a LISA

On top of the eligibility criteria I mentioned, there are some further things to consider before opening a LISA.

The most important is the withdrawal penalty- if you were to withdraw money from your LISA for any reason other than your first home deposit or for retirement, the government will charge you 25% for doing so. Now you might think, well that’s okay because I am only losing the bonus they paid me… right? Wrong!

Let’s say you were starting from scratch and you opened a LISA and made the maximum deposit in one tax year of £4,000. You then receive the government bonus of £1,000 giving you a total pot of £5,000. But for whatever reason, you need to take the money out for something other than a first home deposit or retirement. The 25% government charge will be £5,000 x 25% which equals £1,250. This will leave you with £3,750 (£5,000 – £1,250). You will be worse off since you deposited £4,000 of your own money.

The same principle applies for any level of deposit you would make up to the £4,000 limit. This further emphasises the need to have a separate emergency fund to help you navigate situations where you might need quick access to some cash without being penalised by the government.

In addition to the withdraw penalty, you must have had your LISA open for at least 12 months before you can use it for your first house deposit.

Always conduct your research and shop around for the best LISA for you. If unsure, please speak to a financial advisor.

How To Open a LISA and Start Saving

Opening a LISA is extremely simple. The first thing you need to do is decide which provider is the best for you. Once you have decided, you need to complete all the basic account opening requirements like with any bank account and away you go. You can begin contributing towards your deposit for your first home and start getting free money from the government!

Saving £4,000 is not easy. As mentioned, you don’t have to deposit £4,000, this is just the maximum you can deposit per tax year. Setting up monthly transfers to your LISA can be a really handy way of working towards your goal. For example, to deposit £4,000 in one tax year, you would need to make 12 equal payments of £333.33 into your LISA. If you had a goal of saving £2,000, you would need to save £166.67 per month over 12 months.

Conclusion and Final Tips

To conclude, I hope you now can understand the benefits of using a LISA to save for your first house deposit. There is free money on offer from the government which can significantly boost your overall deposit, especially if you were saving over many years. There are of course eligibility criteria to meet and some key considerations to make before opening a LISA; there are also multiple providers who offer LISA’s. I hope you have been able to learn something from this post and if you are exploring buying your first home and are considering how best to save, good luck!

If you have any questions, please drop a comment below. Also please feel free to check out my other blog posts about all things personal finance. I’d love to hear what you guys want me to write about!