Saving and Investing: Enjoy the Present While Preparing for the Future

Saving and investing serve two different purposes. We save money to plan for shorter—to medium-term goals such as holidays, birthdays, Christmas, new gadgets, or even a home deposit. On the other hand, we invest money to build long-term wealth, letting the power of compound interest work its magic. But how can we achieve an optimal balance between living in the now whilst also considering the future?

I firmly believe that living life in the present, enjoying new experiences, making memories, and buying things that will make you happy and that you value are so important. That’s what life is all about, especially if you are young and have years ahead of you.

At the same time, it would be silly not to think about the future. We still want to be able to enjoy life in our later years without financial instability or stress.

So that’s why I am writing this post. I want to offer my thoughts on strategies to manage both saving and enjoying life now whilst thinking about the future. We shouldn’t feel the need to miss out on things now; the positive effects on our mental health should not be ignored. But at the same time, we don’t want to build a future where we are constantly thinking and stressing about money. So how can we achieve a balance that works for us?

The Importance of Saving for Short-Term Goals

We enjoy life by spending our hard-earned money on the things that make us happy, things like holidays, big life events, a house deposit, or whatever it is. Here, I am referring to the things that generally cost a little more and require you to save money.

I love experiences, visiting new countries, and watching the football team I support (most of the time). These are some of the things that make me happy and what I save money for to enjoy in the now; I am not willing to forgo them. The effect social media can have on our outlook on life is frightening, which is why it is fundamental to take a step back and set clear and attainable goals that are personal to you.

Ask yourself, what do you actually want to do in life? What are the things that genuinely make you happy? Once you have an idea, you can take a little time to understand if it is affordable, and if yes, how much do you need to save to make it happen?

Now that I understand the things that I enjoy and want to do in the future, I set aside a fixed amount of money each month that helps me to get there. You can read more about the importance of building a budget that works for you here.

This provides me with not just financial clarity but also mental clarity because I know I am saving towards things that I genuinely want to do in life. I have no problem with spending higher sums on things that will make me happy, within reason, of course. I know my limits; I can’t afford everything I want to do, but I consider this from the outset. This helped me to avoid any disappointment in the past.

I guess what I am trying to say is yes, planning for the future and having a financial safety net are so important and should not be ignored, but balancing this with the things that will make us happy is really important too.

Tips To Maximise Your Savings

Since the main focus of this blog is to help guide you in making the most of your money, let’s focus on that!

Over the past few years, buzzwords like ‘inflation’ and ‘cost of living’ have dominated mainstream media. I explained why it is important to understand and combat inflation in my post on investing

However, as the Bank of England have raised interest rates to combat the worryingly high levels of inflation that we saw recently, this has presented more opportunities for savers as banks and other providers of savings accounts have been forced to raise the rates they pay us on our savings.

According to Yorkshire Building Society, over £366 billion is sitting in UK current and savings accounts earning interest of 1% or less (report in June 2024). If we are going to save money for the things that we love and want to do, why are we not taking advantage of the savings accounts paying between 4% and 5% in the UK?

Let’s say you needed £10,000 to go travelling for 6 months, this is something that you have wanted to do for years. But you currently have £7,000 in the bank. Let’s also assume that you have this in a savings account paying 1%, you are earning £70 of interest (£7,000 x 1%).

It takes just a few minutes to open an account with another bank or provider of a savings account. At the time of writing this post, there are savings accounts offering rates to savers of around 4-5%. By putting the £7,000 in an account earning 5% interest, you’d be earning not £70 of interest but £350! This significantly boosts your savings pot towards your overall goal a bit faster!

Being a bit savvy, moving our money into accounts that pay the best rates of interest is something that is not talked about enough, but I have just shown you the effect that this can have.

You can find the best-paying savings accounts on the MoneyFacts Compare website. I have used this website for years to filter down to the accounts that pay the highest level of interest so I can maximise the overall return I get on my savings.

If you have wondered whether an individual savings account (ISA) is right for you, you can read all about them in one of my previous posts.

One thing to do before you move any of your money to another account is to check that the provider is FSCS protected. This means that your money is protected up to £85,000 even if the bank, building society, or company that offers you the savings account goes bust.

Building A Financial Safety Net

Having a financial safety net is the most important thing to have in place to help you manage any unexpected or sudden events that require you to fork out a lot of money. This is commonly referred to as an ’emergency fund.’

This is a completely separate pot of money to cover you in case of a surprise or event. Imagine the person we talked about earlier had saved the £10,000 they needed to go travelling, but their boiler broke down or their car packed up, and thousands of pounds were needed to rectify this. If they did not have an emergency fund, their travelling plans may be set back significantly as they may be forced to use their travelling savings for their boiler or car (or whatever event or emergency happens)!

So, having a separate pot of money to protect us from life events and also to ensure that we are not dipping into our savings intended for other things is so important.

And you can probably guess what I am going to say now: This separate emergency fund should probably be in a high-interest savings account. Don’t let the banks take advantage of you by paying small amounts of interest!

Investing for the Future

I’ve written quite a lot about the importance of investing, mainly the power of investing to help create long-term wealth, and one of the easiest ways beginners can begin their saving and investing journey.

I often get asked the question, why would I bother investing if I have to wait maybe 20-plus years before I see the benefits? It’s a great question, but it is not a valid reason (in my view) to disregard investing.

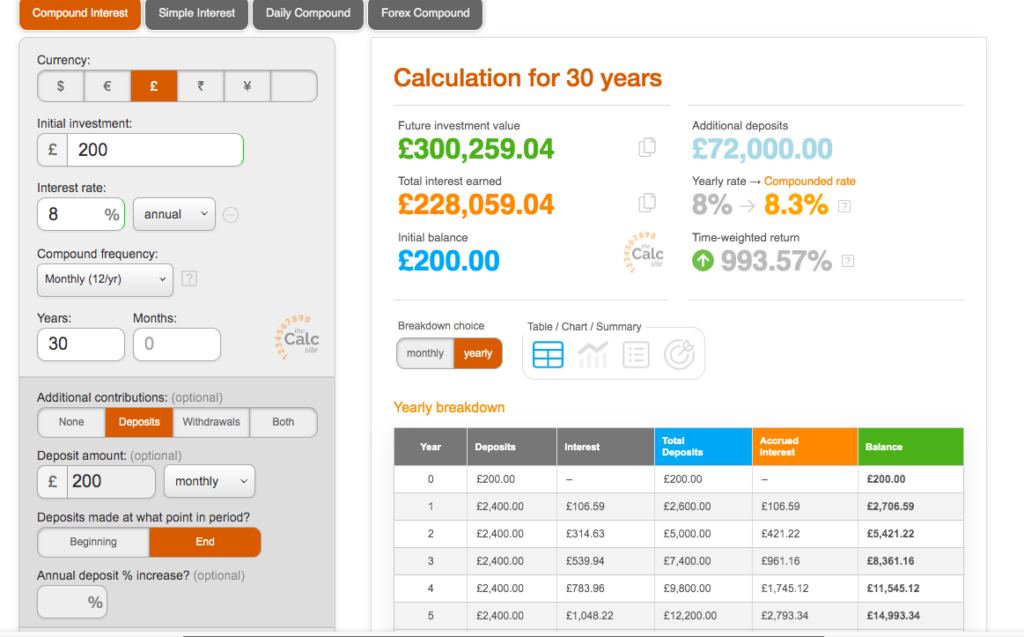

Compound interest over a long period can have remarkable effects, and to emphasise this point, I’ll show you how investing a small amount each month can turn into a very large amount over a long period using a return of 8%.

So, saving £200 a month for 30 years could turn into £300,000 based on roughly what the stock market has returned historically. I’ve used 8% here; some research shows 10%, but I have been more conservative.

You might have missed the true value of investing here and why compound interest is so powerful. You can see from this calculation that of the £300,000 pot, £228,000 is interest you have earned from investing.

So, in this example, over 30 years, you will have deposited roughly £72,000 (£200 per month for 30 years), and the £228,000 has come from investment gains. Pretty good, right?

That’s the point of investing over a long period: you can build up a sizeable pot of money.

Now you understand the argument of why investing money over 20 plus years is worth it? I’m not personally willing to forgo the opportunity to have this waiting for me in the future alongside any other things I may have, such as my pension.

The good news is that if you are working, you are probably already investing through your pension. This is not a reason not to invest separately but a word of encouragement if you think you may be behind.

What is important to know is that this example is hypothetical, and stock market returns similar to the past are not guaranteed in the future. This is not financial advice but instead education on investing. Please consult a financial advisor before making any investment decisions.

Enjoying Life Now Without Financial Guilt!

The key theme I want to get across with this post is balance. Saving for our short-term goals to enjoy the life we want to live now is important, but so is planning for the future.

We can set aside money for the now but also for the future to reduce the risk of having our finances burden or stress us out in the future.

I set aside money for the holidays and experiences I want to enjoy in the near term, but I also invest for the future to provide the clarity that, all going well, I will be financially sound for my entire life.

Life is all about balance. Have a plan so you don’t have any financial guilt or stress overwhelming you. Save for the things that make you happy and not what you think will make others happy or impress them!

Set some goals and work from there; you deserve to be happy now and for years to come. You can achieve both with the right strategies and mindset. Take small steps to start; good luck!