How To Invest Into The Stock Market: A Simple Guide For Absolute Beginners

Have you ever considered investing into the stock market? But before you begin, the common fears that hold most of us back creep into your mind—things like ‘I don’t know where to start’, ‘investing is only for rich people’, and ‘I might lose all of my money.’

Trust me, I get it. These are the thoughts that came into my mind before I began my investing journey. I was confused and overwhelmed by the sheer volume and complexity of information and almost gave up on the idea of investing completely. I found that so much of the information on the internet was focused on the US, and I had to spend a lot of time digging around for UK-specific information and rules. Thankfully, I found some amazing videos and books that focused on how to invest into the stock market from the perspective of a UK-based investor.

Once I started to invest into the stock market, it became clear that investing is so much simpler than we are made out to believe; what I felt was lacking was clear and easy-to-understand content that anybody with absolutely zero investing knowledge could pick up and take action from.

So the purpose of this post is to reassure you that investing is much more simple and accessible than you think. Not only will I explain what investing is and why it is one of the best ways of generating serious long-term wealth, but I will also break down each step you need to understand and take to begin your investing journey. My aim is that once you finish reading this blog post, you will feel far less overwhelmed and you will know how to invest into the stock market.

To put you at ease before we get into the content, I now spend roughly 2 minutes per month on my investments, and I spend no time stressing or worrying about them because of the steps I have followed and will explain to you in this post.

Please note that this is not financial advice; it is educational content to help improve your personal finance knowledge.

So, let’s begin!

Why Invest (The Power of Long-Term Growth)?

You may wonder why individuals like you and me should seriously consider investing into the stock market. Many powerful arguments favour investing, and it’s quite likely that you have already heard them: things like ‘my money does nothing in the bank’ or ‘I need to beat inflation.’ But what does this mean?

According to Yorkshire Building Society, over £366 billion is sitting in UK current and savings accounts earning interest of 1% or less (report in June 2024). £366 billion! Yes, we need to meet our day-to-day spending needs and ensure we can sustain a living, but that figure is extremely alarming. Why? Inflation!

Inflation is simply the percentage rate at which the ‘stuff’ we buy rises in price. And inflation since the pandemic has been a hot topic in the news, sparking the cost-of-living crisis here in the UK. At its peak in October 2022, inflation was 11.1%. So if we have money in the bank earning less than 1% and inflation is anything above this, what does this mean for our money? In short, it means we can afford less ‘stuff’ as the cost of the stuff we buy is rising faster than the rate at which our money is growing.

For example, let’s say that today your weekly shop costs £100. But next year, inflation is 10%, meaning that your weekly shop costs £10 more and totals £110 for the same stuff as last year. Your original £100 will not be enough to afford the same weekly shop because prices have gone up. That’s the impact of inflation; it erodes or strips away your spending power. Unless your income also increases, you’ll either need to spend more or buy less.

So we want our money to grow at the same rate, if not higher than the rate of inflation. Otherwise, we will be able to afford less and less. Whilst billions sit in bank accounts earning less than 1% and the rate of inflation is above this, we are losing spending power. This is where investing takes the stage.

Broadly, investing into the global stock market has delivered returns above the rate of inflation, meaning that by investing, we can actually increase our spending power. According to Curvo, by investing broadly into the global stock market (don’t worry, I’ll explain what this means later), returns have been around 10% per annum over the past 20 years. With UK inflation currently being reported to sit at around 3%, this shows us the power of investing. We cannot only beat inflation by investing over the long term, but we can smash it!

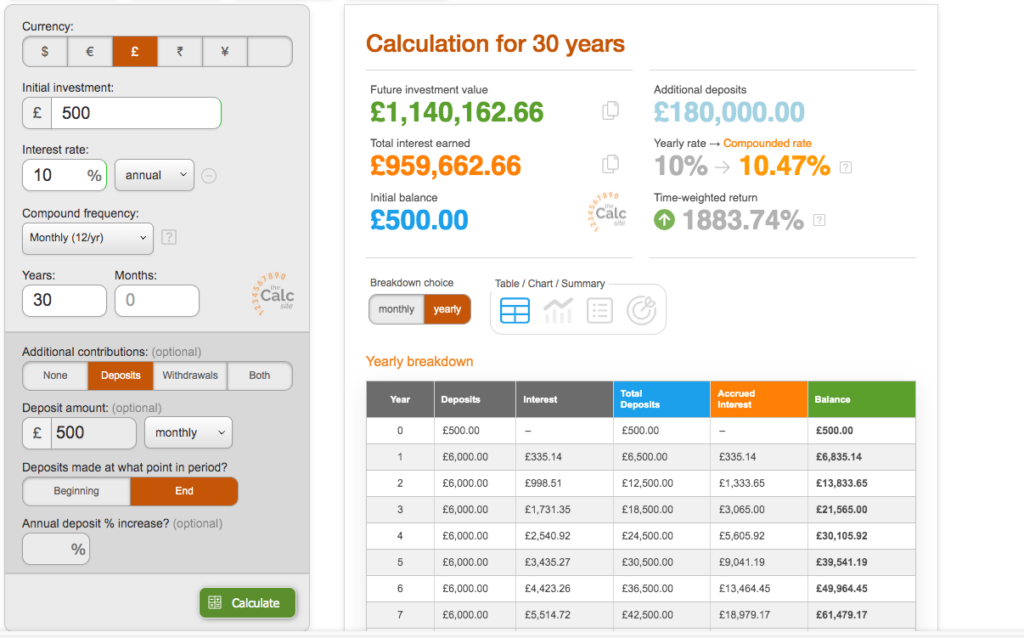

You may have read my post on compound interest. £100 invested each month can turn into hundreds of thousands of pounds with a 10% return. If we increase our investment amount, the numbers begin to get quite scary, and yes, we are talking millions. Even at returns of 6%, 7%, 8%, and 9%, the numbers are scary. Just use this calculator and find out for yourself.

As Albert Einstein said ‘compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.’ And I truly believe this is true. If at this point you don’t see the impact compound interest can have through the lens of investing, give the last section another read.

Investing has historically outpaced inflation over the long term, which is why many people use it as a tool for wealth-building for themselves, their family, and future generations.

So… what actually is the stock market, and how can we get started?

What Is The Stock Market (A Simple Explanation)

The stock market is a place where people can go to buy and sell pieces of other companies, this is what it means to buy shares or stocks in a company. Just like you go to a local farmers market to buy fresh produce, investors go to the stock market to buy and sell shares of companies such as Apple, Microsoft, or Tesco. Companies will offer pieces (shares) of their companies to investors in exchange for money, which they will usually use to grow their business, for example, expanding production or building new facilities.

You can also imagine a company as a pie being sliced into tiny slices. When you buy a share in a company, you are effectively buying a tiny piece of that company or a tiny slice of a pie. You become a part owner of that business! Naturally, you want the value of your shares in the company to rise in value, and this is mainly determined by the performance of that company. For example, if Tesco beats its profit targets, investors may become excited, and the demand for a share in Tesco may go up. This will cause the price of the stock to rise (all other things being equal).

On the other hand, companies can perform badly, and stocks can fall in value, sometimes by 100% if the company goes bankrupt!

Okay, so we understand the basic mechanics of the stock market—but what about the buzzwords you hear on TV, like the FTSE 100 or the S&P 500? These aren’t companies, but rather they are stock market indexes that represent a group of companies.

What Is An Index?

Think about an index as a basket or group of companies. Each basket represents different mixes of companies.

- The FTSE 100 index represents the 100 largest companies on the London Stock Exchange, think HSBC and BP.

- The S&P 500 index represents the 500 biggest companies in the USA. Think Apple and Microsoft.

- The FTSE All-World Index comprises of thousands of huge companies from around the world.

The word ‘index’ may sound confusing to start, but it is simply a word used to represent a group of companies. So when you next hear ‘FTSE 100’, you’ll know that the 100 largest companies on the London Stock Exchange are being spoken about.

So we now know what an index is, but what can we invest in?

Different Ways To Invest Into The Stock Market (i.e What Can I Buy)

There are different ways that we as investors can invest into the stock market. I am going to talk about some of the main ways, along with the pros and cons of each.

Buying individual shares in companies (i.e, shares in Apple)

✅ The potential returns can be significant

✅ You can buy individual shares in your favourite companies

❌It is a lot riskier than other investing options; if you owned shares in only one company and it went bankrupt, you would lose all of your money

❌The research required to truly understand the business and work out if it is a good investment requires a significant time commitment and a willingness to understand financial statements

So investing in individual shares is suited to the type of person who is willing to take on a lot more risk (in exchange for hopefully higher returns) but is willing to commit a substantial amount of time to researching and understanding each business.

Buying Funds (ETFs & Index Funds). Remember the indexes I explained earlier (FTSE All-World, S&P 500, FTSE 100, etc)- well, you can buy something that tracks an entire index i.e. it buys all the companies that form part of that index. This is called a fund.

✅ Instead of investing in individual companies, you can buy a fund that tracks a specific index such as the FTSE All-World giving you exposure to potentially thousands of companies (this is what we refer to as diversification) all through one investment. This removes the stress of having to work out which specific company will do well. It is a very passive way of investing.

✅ It is an extremely cheap and easy way to invest, taking minutes to set up and complete each time you invest

✅ You reduce your risk exposure because you spread your money among hundreds, if not thousands of companies. So if one company goes bankrupt, your entire investment doesn’t go to zero!

❌ Since you are exposed to lots of companies all through one investment and since the fund seeks to track the index, you have less control over the specific companies you invest into.

This option is likely to be the most suitable for beginners but also for those who want a laid-back approach to investing (like me!). You can spread your money across hundreds or thousands of companies all through one investment. For full disclosure, this is how I choose to invest my money.

Buying actively managed funds. This is where you invest your money into a fund (similar to the above), but there is a professional (usually referred to as a fund manager) who will personally manage your money with the core aim of delivering higher-than-average returns.

✅Your money is looked after by a professional fund manager who is likely to have years of investing experience

✅You may be able to gain exposure to more unique or specialist areas of investing through professional fund managers

❌ It is more expensive than investing using standard funds

❌ Historically, the majority of professional fund managers fail to deliver better-than-average returns

Actively managed funds are likely to suit individuals who have higher sums to invest and who are willing to pay more for having their money actively managed. However, the average fund manager usually fails to beat the average stock market return. So once you take into account the additional fees, you have to work out whether this is a good option for you. Trust me, fees need to be taken seriously as they can cost you thousands or potentially hundreds of thousands of pounds over years of investing.

Robo Advisors

Robo advisors are available on online investing platforms like Nutmeg and Moneybox. In short, you answer some questions about your risk profile and goals. After this, your investments will be automatically chosen based on your answers.

✅ Minimal work is required; all you need to do is answer some questions, and away you go.

✅Removes the stress of having to pick companies or funds

❌ It is generally more expensive than investing in funds or companies yourself

Now, let’s move on to a step-by-step guide to getting started. I’ll also outline how I invest my money.

Step-By-Step Guide To Start Investing Into The Stock Market

Let’s break down the key things to do to get started with this whole investing thing.

Firstly, decide which investment platform you are going to use (think of this as your bank provider). There are many out there, such as Vanguard, Trading 212, AJ Bell, Hargreaves Lansdown, etc. When I was deciding which platform I was going to use, things like fees and ease of use were essential to me as well as what investment options were available. You’ll need to do your research here, but there are so many great YouTube videos out there that break down the different options.

Once you have decided which investment platform you are going to use, you simply need to open an account with them, just like you would open a current or savings account. Please take the time to read my previous post on ISAs. There are generally two main types of account you can open, either a general investing account or a stocks and shares ISA. In an attempt not to repeat myself from my previous post, the tax advantages of a stocks and shares ISA should not be ignored.

For full disclosure, I use Trading 212 as my investment platform and their stocks and shares ISA to hold my investments. I’ll speak further about how I came to this decision in a future post.

Okay, so now that you have a platform and an account, the exciting part begins. You select your first investment.

What A Beginner Could Consider Investing Into

I remember asking myself, what shall I start with? Where shall I put my money? It was completely overwhelming and stressful. So I wanted to find the easiest and most simple way to invest into the stock market with minimal ongoing work required.

Remember how I explained what a fund and index were? Well, there are investment products called index funds and exchange-traded funds (ETF). They have slight nuances between themselves, but ultimately, an index fund or ETF aims to track the performance of an index. There are index funds and ETFs that aim to replicate the performance of the FTSE All World Index, S&P 500 index, and FTSE 100 index, for example. What this means is that the index fund or ETF buys all of the companies that make up the index. So, if the companies that make up the index rise in price, the value of your investment goes up.

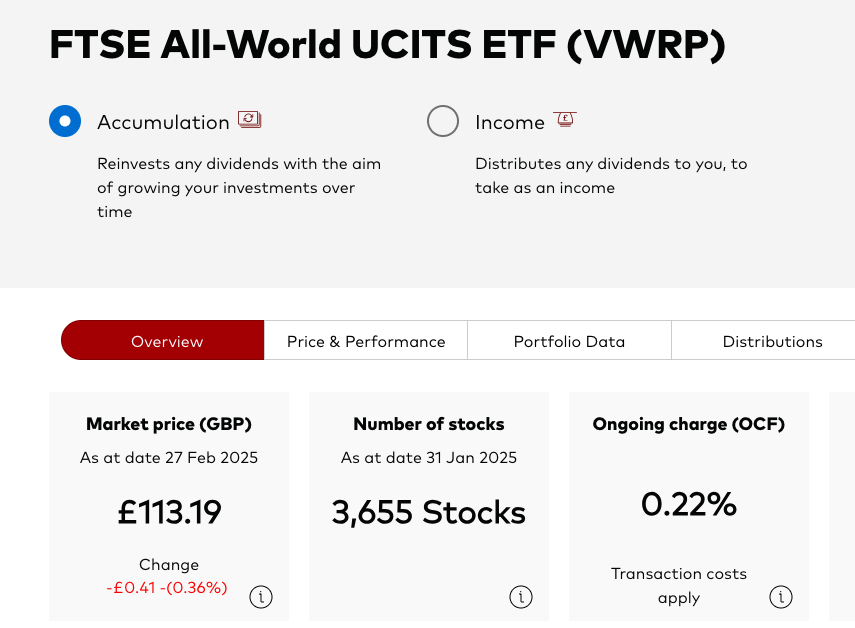

For full disclosure, my portfolio is made up of one ETF that I put money into each month when I get paid. The ETF tracks the FTSE All-World Index, which comprises of over 3,500 large and mid-sized companies in developed and emerging markets. The fund is called FTSE All-World UCITS ETF (VWRP).

This particular ETF has performed very well recently (return of 22.03% in 2023 and 17.19% in 2024). This has been driven by strong global stock performance, predominantly by major technology companies like Apple and Nvidia. Of course, these returns are not an indicator of the future, average returns are generally lower than this (these are also not guaranteed).

Now, of course, this is not a recommendation; it is purely to illustrate that there are ways that in one simple investment, you can gain exposure to companies all over the globe.

There are so many different ETFs and index funds out there which seek to replicate the performance of different indexes. My reasoning for going with VWRP was global exposure, low cost, and an overall bet that the world will keep on ticking over in my lifetime and will therefore hopefully deliver decent returns. But you might want to focus solely on the UK or US markets; that is up to you!

Like always, it is critical to consider your financial circumstances and speak to a financial advisor if you need help with specific investment decisions.

Final Tips and Mistakes To Avoid

As you begin your investing journey, I want to share some final wisdom and pitfalls to avoid.

- The power of using a stocks and shares ISA cannot be understated. I have written a whole post about ISAs, but using a stocks and shares ISA as your investing account will minimise your exposure to any form of tax on the gains you make from your investments. This could save you tens of thousands of pounds over the long term.

- Be prepared to be patient. This type of investing is not a ‘get rich quick’ scheme. Investing benefits those who are willing to wait years so that compound interest can work its magic. Don’t expect to become a millionaire after a couple of years, it is a long-term game.

- Consistency is key. I invest a portion of my salary each month when I get paid, no matter what. It doesn’t matter if the market is up or down; I just keep investing. Why? Because I have a long-term mindset and know that by slowly but consistently drip-feeding money in, I’ll be rewarded later.

- Manage your emotions. I try not to check how my investments are performing too often because I know I don’t need the money right now. Otherwise, if the market is performing badly, the temptation to sell will creep in. Panicking and selling during a market crash is one of the worst things to do.

- Only invest what you can afford to lose. The aim of the game is to make a lot of money from investing. But I only invest what I am prepared to lose each month. Anyway, if the global stock market crashed tomorrow, we’d probably have more to worry about than our investments!

- Time in the market trumps timing the market. I have no idea whether my investments will rise, fall, or do nothing today, tomorrow, next week, next month, or even in the years to come. And I’m okay with that. Trying to time the market has proven to be a fool’s game, so I stick to my monthly investing schedule and let compound interest do its thing.

Final Tips And Encouragement

I hope you have been able to learn something valuable from this post; better yet, I hope I have given you the confidence to begin exploring your investing options. It has been one of the most eye-opening things to which I have exposed myself to over the past few years, and I feel extremely fortunate.

Take it easy, make use of other resources as well, and be curious. There is so much out there to learn, but by just getting started, you will be ahead of 99% of others.

I’d love to hear in the comments if there is anything important you think I have missed or other stuff you want to learn about investing. Stay tuned for my post, which is in draft- what to do if the stock market crashes!