ETF and Index Fund Investing For Beginners: What Are Tracker Investment Funds?

In one of my previous posts, I outlined how investing using tracker investment funds (index funds and ETFs) could be a good segway into investing for beginners. In this post, I intend to provide further details on index funds and ETFs (tracker investment funds) and why these are one of the easiest ways for beginners to start investing in the stock market.

Investing jargon like tracker investment funds is overwhelming, complex, and, quite frankly, can easily put people off investing. I’m determined to break down the complicated financial jargon into easily understandable language so that anyone can take action and begin building wealth.

Like always, this is not financial advice. Let’s get started.

What Are Tracker Investment Funds?

Let’s start with the very basics. What does a tracker investment fund do? The key thing you need to understand are indexes. I explained what these are in my stock market investing post, but I’ll break them down even further here as they form the fundamental basics of investment tracker funds.

An index is simply a group of companies. An index can represent different groups of companies from all over the world. There is an index that groups thousands of companies from around the world. There is an index that groups the 500 biggest companies in the USA. There is an index that groups the 100 biggest companies listed on the London Stock Exchange. There is an index that groups some of the biggest technology companies in the world. You get the picture. An index can simply be referred to as a basket or group of companies. I have listed some of the main indexes below.

- The FTSE 100 index represents the 100 largest companies on the London Stock Exchange, think HSBC and BP.

- The S&P 500 index represents the 500 biggest companies in the USA. Think Apple and Microsoft.

- The FTSE All-World Index comprises thousands of companies from around the world.

Ignore the FTSE and S&P jargon for now, they are organisations that create the indexes.

So we now understand what an index is (a group of companies), but where do investment tracker funds come into this? Well, investment tracker funds allow us beginner investors to automatically gain exposure to an entire index, all through one investment. We can quite literally buy a tracker fund which tracks the S&P 500 index, therefore spreading our money across the 500 biggest companies in the USA.

Investment tracker funds are commonly referred to as index funds or exchange-traded funds (ETF). Don’t worry about the jargon here, I’m going to break it down for you.

When you buy an index fund or ETF, depending on what index it is tracking, you gain exposure to all of the companies in the index! So, in a few clicks on your phone, you can buy a tracker fund and, within seconds, be invested in the 500 biggest companies in America (S&P 500) or the 100 biggest companies on the London Stock Exchange (FTSE 100), etc.

Huge companies like Vanguard offer many different tracker funds which track all sorts of different indexes across the globe. Other companies like Blackrock offer similar products.

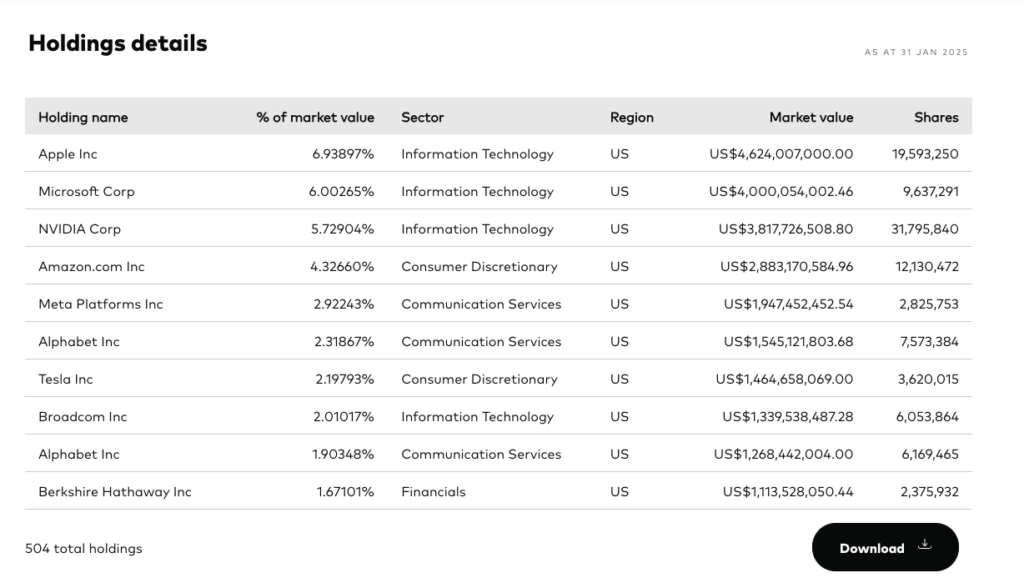

You may be wondering- if your money is invested in an index fund or ETF that tracks the S&P 500, or the biggest 500 companies in America, how is your money spread? Is it done evenly? Usually, the answer is no. The bigger the company in the index or basket, the more money that gets put towards this company. For example, if you invested £1,000 into an index fund or ETF tracking the S&P 500, roughly 6.9% would be invested in Apple, 6% in Microsoft, 5.7% in Nvidia, etc. This is because they are bigger companies as measured by their market value (see below image)

These allocations fluctuate based on each company’s size as they change over time.

Should Beginners Consider Investment Tracker Funds? (Pros and Cons)

I am a firm believer that index funds and ETFs are very plausible options for investors looking to start their investing journey. Why?

- You can invest in hundreds, if not thousands of companies all through one index fund or ETF. This helps to spread risk across multiple companies, therefore diversifying your portfolio.

- Instead of looking for the next company to ‘go to the moon’, you can avoid the risk and stress of trying to find the next hot stock. For inexperienced investors, trying to pick individual stocks can be an extremely risky endeavour. Index funds and ETFs invest in lots of stocks for you in a few clicks.

- It is one of the cheapest ways to invest; the fees associated with broad-based index funds and ETFs are usually cheaper than other alternatives, such as managed funds where a professional manages your money for you. The majority of fund managers fail to beat the average stock market return in their country over the long term!

- It is the definition of passive investing. You can invest money at regular intervals and apply a ‘set and forget’ mindset. You can let the companies in the index that you are invested in do the work for you.

There are some drawbacks to tracker funds. One is that you cannot control which companies are in the index that you invest in. If you want to invest in a fund that tracks the S&P 500, you cannot ask them not to invest in some of the companies in the index.

Another consideration is ethical investing. There may be companies in the index that don’t align with your values or goals, and it can be tough to avoid them due to their sheer size. There are some ESG-focused funds however!

If you decide that you want to track a particular index, you must accept that the returns you will achieve will not outperform the index you are tracking. You will get the same return as the overall index (see the risk section below for further details).

This hopefully gives you some food for thought when deciding if investment tracker funds will help you to achieve your goals.

How To Get Started

As a beginner to the investing world, choosing which investment account provider to use and the type of account you open are key. I outlined all you need to know about this in my previous post. Accounts are provided by a lot of different companies like Trading 212, Freetrade, Hargrevaes Landowns, AJ Bell, and InvestEngine (among others). Each of these offers a stocks and shares ISA, an important tool to help protect our investment gains from any tax.

Once you have an account open, you can begin to search for the fund or ETF that tracks your desired index. There are slight differences between index funds and ETFs, but the key at the moment is to remember that they both seek to achieve a very similar objective, invest in all of the companies that make up a particular index.

Depending on the provider you decide to use, they will offer lots of different ETFs and index funds. The main question that you want to ask yourself is: What level of exposure do you want?

- Do I want exposure to the FTSE 100, i.e. invest in the 100 biggest companies listed in the UK

- Do I want exposure to the S&P 500, i.e, invest in the 500 biggest companies in the USA

- Do I want exposure to the global stock market, i.e invest in thousands of companies across the globe

- Or do I want exposure to a particular sector, i.e. technology? Yes, some indexes include companies from specific sectors like technology firms, pharmaceutical firms, etc

This is a personal decision that you need to make based on your willingness to take on risk.

You can even invest in indexes that represent not just companies but also other assets such as gold and bonds.

Personally, I made the decision that I wanted exposure to an index that represented the global stock market. I didn’t like the idea of putting all of my money in the USA despite the USA stock market performing so well recently (especially as I am from the UK), and I knew that I didn’t want to just invest in the UK. I also liked the idea of exposure to lots of other countries. This is what led me to believe that for my financial circumstances, a global approach would strike a good balance between potential reward and risk.

So, once you know the investing approach you want to take, the next step is to find the ETF or index fund that will help you to achieve this. Each investing platform, i.e Trading 212, has an overwhelming number of tracker funds available to choose from; the key is to filter them down.

But before we do this, let’s summarise.

- An index is a group or basket of companies, e.g the largest 500 companies in the USA

- An ETF or index fund is a financial product that invests in the companies that form a particular index

- Companies like Vanguard and Blackrock create these ETFs and index funds

- ETFs are made available on all major investing platforms like Trading 212 and AJ Bell, etc

- You need to decide what investing approach you want to follow, which will then help you decide which ETF or index fund (or combinations) align with this

You can use the websites of major index fund and ETF providers to find the right tracker fund for you.

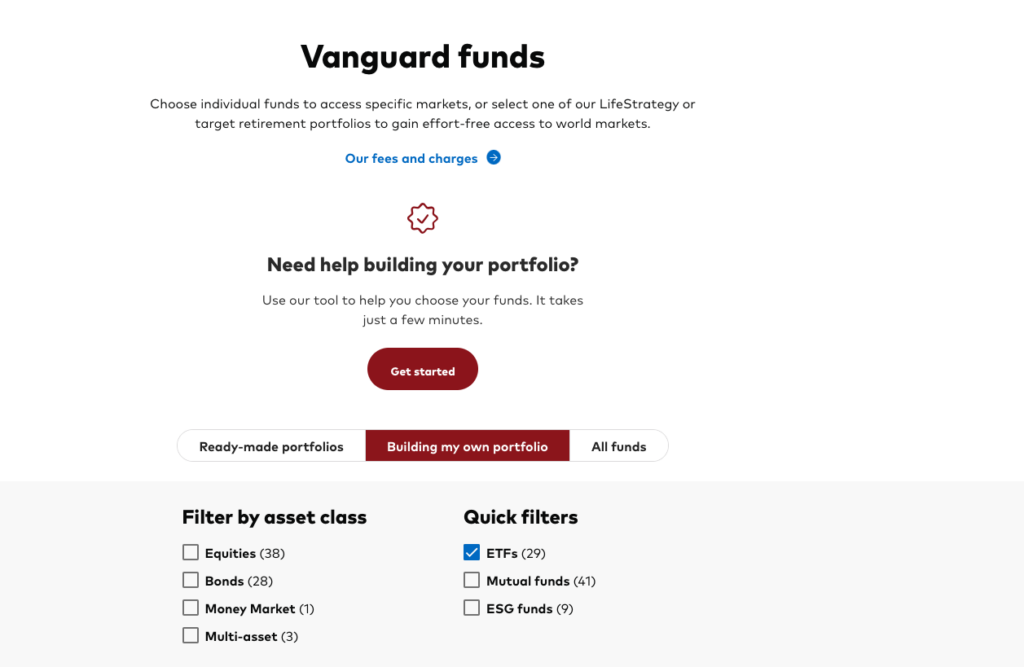

I use an ETF created by Vanguard. I used their website to filter funds that align with my desired investing approach (global stock market exposure) and found the ETF that tracked the index I wanted. I chose Vanguard for its stellar reputation in the investment world, but you can also consider other ETF and index fund providers.

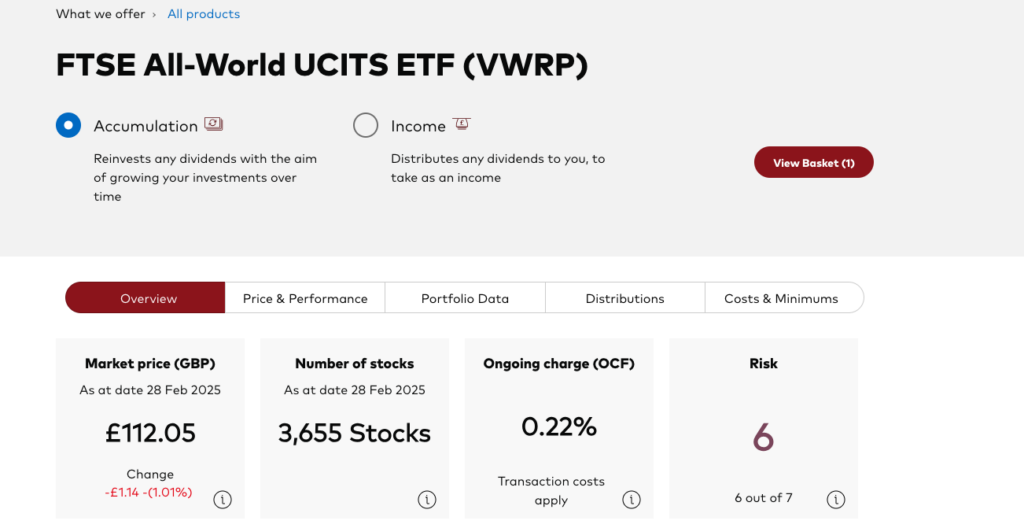

Here are some screenshots that I have taken from the Vanguard website based on my desired investing criteria. Firstly, I knew I wanted an ETF, so I filtered for this

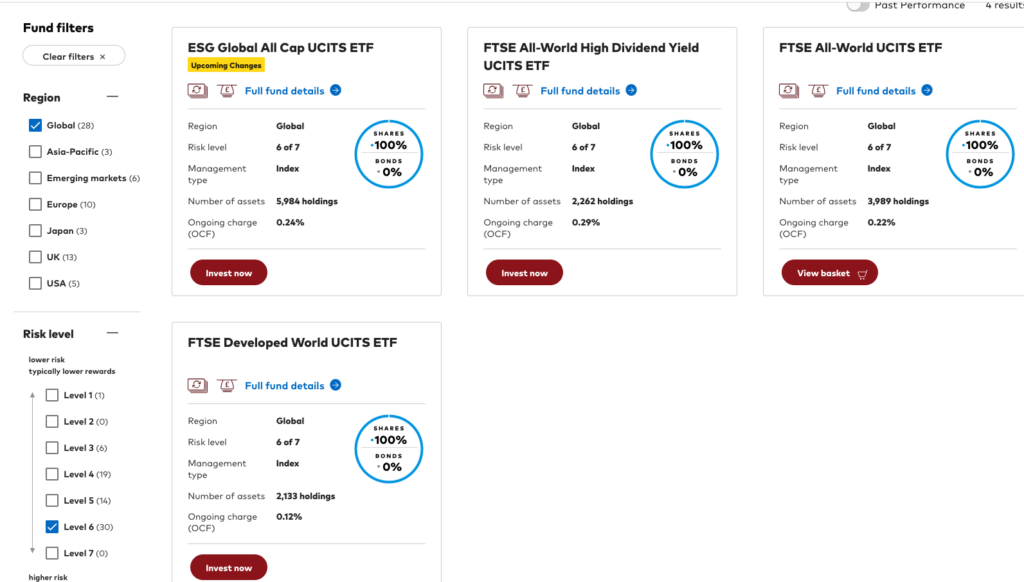

And I knew that I wanted global exposure. The risk criteria is important to look at as your risk tolerance may be different to mine. Following this, I found four ETFs that met these criteria. An ESG-related ETF, a dividend-related ETF, a world-focused ETF, and a developed world ETF.

This led me to pick this fund as it aligned with what I wanted to achieve.

Based on your risk tolerance, investing time horizon, and overall goals, some different asset classes or investments may better suit your needs and goals. Please speak to a financial advisor if you need help tailored to your financial situation. This post is not financial advice.

The purpose of this section is to take you through the decisions you can make during this process. It is for educational purposes only.

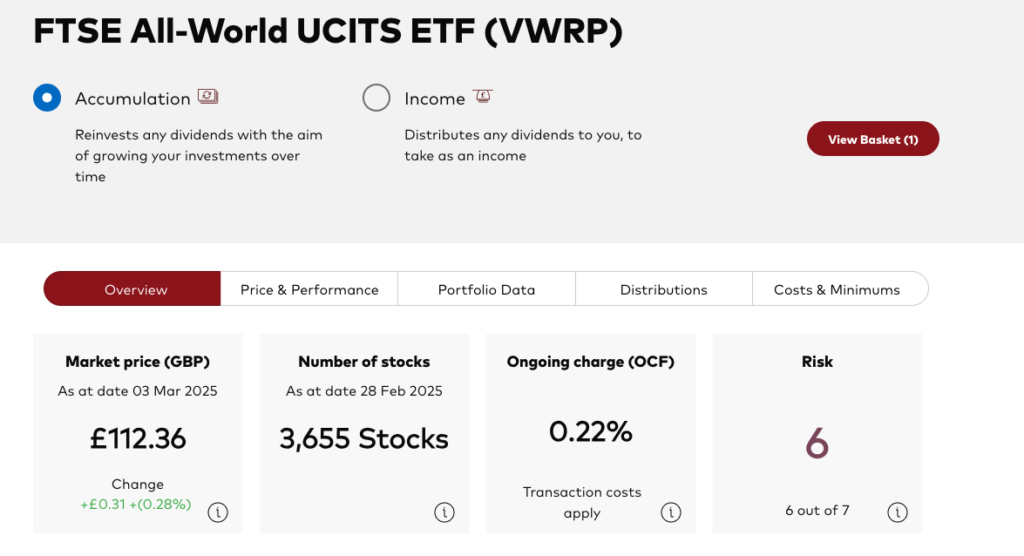

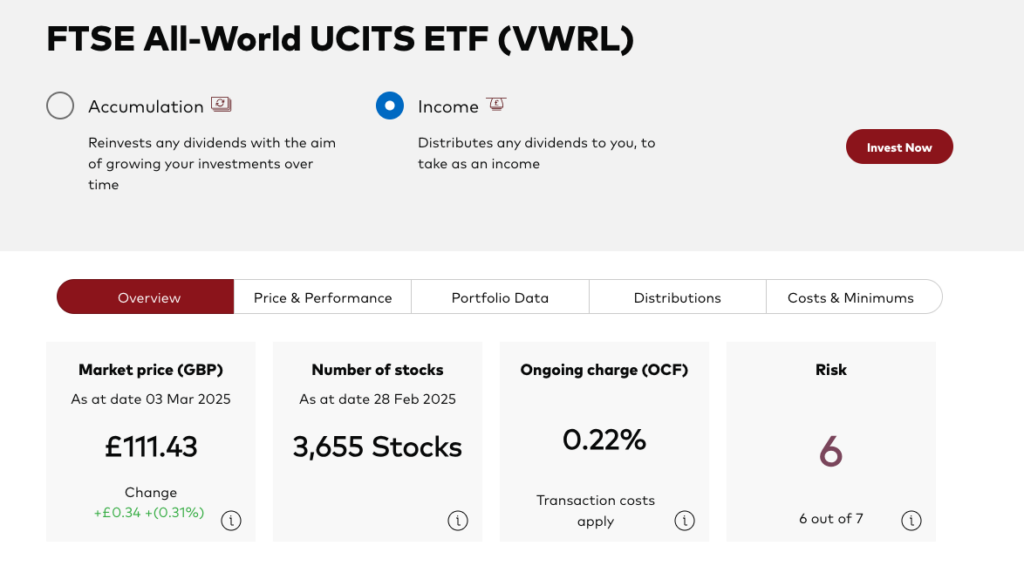

Accumulation Vs Distribution Funds

Now, I promise to keep this as simple as possible. When you invest using an ETF, you will usually be given the option to choose a distributive or accumulative version. The overall objective of the ETF remains the same regardless of whether the ETF is accumulative or distributive—track the relevant index.

When companies make a profit, they will sometimes reward shareholders or investors with a dividend. Think of this as a reward for being an investor in that company. For each share you own, the company will usually pay a small percentage of the share price as a dividend.

Since ETF investing exposes us to hundreds, if not thousands of companies, the ETF provider, e.g Vanguard, will make an overall payment directly into your investing account periodically, which consists of the dividends you are owed from all the companies in the relevant index. This is what a distributive ETF fund is- you are paid the dividends.

An accumulation version, however, will automatically reinvest the dividends you are owed back into the ETF you own, thus adding to your overall investment. This is the version I have chosen to maximise the funds I have invested.

The choice you make will depend on your financial circumstances.

You can see from the two screenshots below that an ETF can have two versions (accumulative and distributive), but what the ETF invests into is the same.

Risks

Index fund and ETF investing are great places to start for beginners, but there are some key risks to be aware of.

Most index funds and ETFs are market cap-weighted. All this means is that the bigger the company in the index, the more of your money that gets invested into that company. The smaller the company, the less of your money that goes into it. In the event of a crash or dip in share prices of the bigger companies, since we have more money in these companies, our investments will be affected more and vice versa.

Diversification across lots of companies reduces individual company risk, but in a big market crash, diversified funds will still drop significantly. This is important to know.

Due to the sheer size of the US stock market, a large proportion of the major indexes out there have a big allocation towards US stocks. The S&P 500 represents the largest 500 companies in the USA, but even global stock market funds have 67% of their holdings in the US. Therefore, if the US stock market were to crash, this would affect all indexes with exposure to the USA.

Fees are important to consider. The fees associated with the investment platform, e.g Trading 212 or AJ Bell, are different, so you will need to decide what platform is best for you. Some platforms are free, such as Trading 212. But ETFs and index funds have what is called an ongoing charge (OCF). Minimising the fees we pay should be a key factor to consider; generally, ETFs and index funds are reasonably cheap, some as low as 0.07%. There isn’t a set rule of thumb as to what is expensive, but in my view, alarm bells would start ringing at anything above 0.30% (for passive ETFs and index funds).

Finally, the past performance of the ETF or index fund is important. As we now understand, an ETF or index fund aims to invest in a set group of companies that make up a particular index. But when you look at the ETF or index fund, has it achieved a return similar to the index is tracks? Ask yourself, if the S&P 500 index has returned 10% this year, has the ETF or index fund that seeks to track this index delivered a return very similar to 10%?

If there is a notable difference, this would indicate that the ETF is not tracking the index very well. You can find this information on the fact sheet of the index fund or ETF.

See below an example of a good-performing ETF compared to the index it seeks to track. The two bars are very close together (one represents the ETF return, the other the index return itself).

Final Tips

I have mentioned a stocks and shares ISA quite a few times now, but I cannot emphasise enough the tax benefits of this type of investing account. Investing in a stocks and shares ISA could quite literally save you hundreds, if not thousands of pounds in tax throughout a long period of investing.

Regular contributions to the ETF or index fund (or combinations) that you choose is a great investing habit to pick up. If you’re in it for the long term, short-term price movements are irrelevant and regular contributions will mean you get to buy more when the price is lower and less when the price is higher (assuming the contribution stays the same), which helps smooth out the price you pay.

Conclusion

I hope this post has helped you understand one of the ways a beginner looking to start investing in the stock market could begin their journey.

It is how I began and the method I still use to invest my money.

Thank you for reading! Take a look at the rest of my blog posts here!